Unblocking Potential - Part 2. Internal risks

This is the second post where I am looking at ways

that a business could be blocking its own potential and making suggestions for

unblocking the ideas, creativity and innovation that fuels future business

success.

2. Internal risks

‘Safe is risky’

Seth Godin

Business Intelligence has become

big business. Companies, quite rightly,

want to analyse data they collect from customers, suppliers, distributors and

employees so that they make informed decisions about investment in products and

services and sales and marketing strategies.

Business systems age and are replaced b ever more sophisticated and

expensive back-end software that integrates everything from financial reporting

to inventory control.

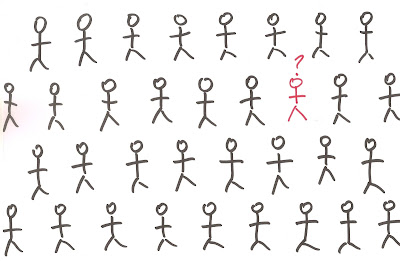

Some businesses spend so much

time and effort focusing on improving business intelligence systems and

analyzing data to within an inch of its existence in order to try to reduce or

even eliminate risk in decision making – to make ‘safer’ decisions. This doesn’t always have the desired

effect. Building or rebuilding these

systems can sometimes be a risk in itself – and not just a financial one. In extreme cases the focus of the business

slips becomes internal. Vast armies of

staff are assigned to ‘change agendas’ that require them to focus on internal

systems. The company becomes so focused on internal issues that it loses its

focus on the customer. This means that

opportunities go unnoticed and customer interest can slip away.

Part of any business strategy is

risk analysis and mitigation. While all

companies must take internal risks to modernise or improve, it is also

necessary to identify external, customer facing risks. It seems like an obvious thing to say, but

the customer must be at the centre of focus.

The risk of not taking customer-facing risks in today’s rapidly changing

markets is high.

‘Creativity

requires the courage to let go of certainties.’

Erich

Fromm

Comments

Post a Comment